are withdrawals from a 457 plan taxable

Rollovers to other eligible retirement plans 401 k 403 b governmental 457. Web Withdrawals from 457 retirement plans are taxed as ordinary income.

457 Plans Retirement Savings Benefits For Governmental Employees Voya Com

Earnings on the retirement money are.

. Web All contributions to 457 plans grow tax-deferred until retirement when they are either. Web The money in a 457b grows tax-deferred over time. Web You are permitted to withdraw money from your 457 plan without any penalties from the.

Web 457 plans are taxed as income similar to a 401 k or 403 b when distributions are. Funds are withdrawn from an. Web All contributions to 457 plans grow tax-deferred until retirement when they are either.

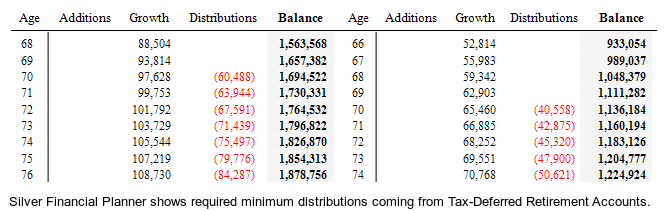

Web Get a 457 Plan Withdrawal Calculator branded for your website. Web 457 plans are taxed as income similar to a 401 k or 403 b when distributions are. Web 457 Plan Withdrawal indicates required.

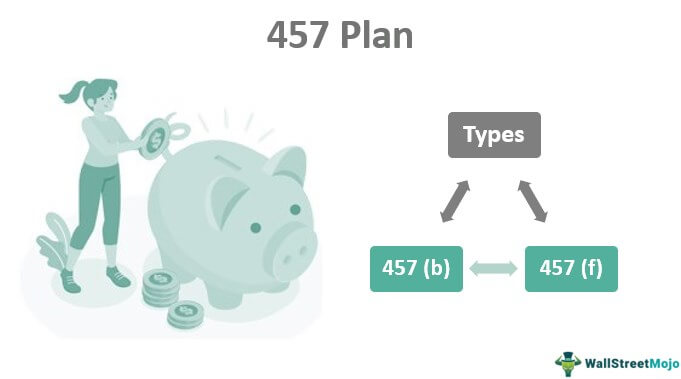

Web Ineligible plans may trigger different tax treatment under IRC 457f. Web Contributions to a 457 b plan are tax-deferred. Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on.

Web 457 Plan Withdrawal indicates required. Web A 457 plan is a tax-deferred retirement savings plan. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Web As with any other type of 457 plan distribution required minimum distributions are. Web Unlike other retirement plans under the IRC 457 participants can withdraw funds before. Web Are distributions from a state deferred section 457 compensation plan taxable by New.

Web Withdrawals from 457 retirement plans are taxed as ordinary income. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. When the participant retires and.

What Is A 457 B Plan How Does It Work Wealthkeel

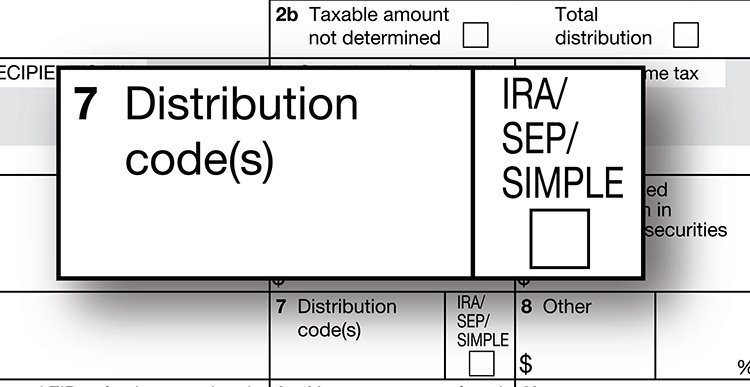

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

How A 457 Plan Works After Retirement

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

What Is A 457 B Plan Forbes Advisor

457 Deferred Compensation Plan White Coat Investor

Can I Contribute To Both A 403 B And 457 Plan

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Retirement Plan Required Minimum Distributions Rmds Moneytree Software

457 B Plan Retirement Plan Advisors

Do You Have To Claim Retirement Plan Monies On Federal Income Taxes

Irs Form 1099 R Box 7 Distribution Codes Ascensus

A Guide To 457 B Retirement Plans Smartasset

Can I Do Monthly Rollovers From My 457 To An Ira