michigan sales tax exemption nonprofit

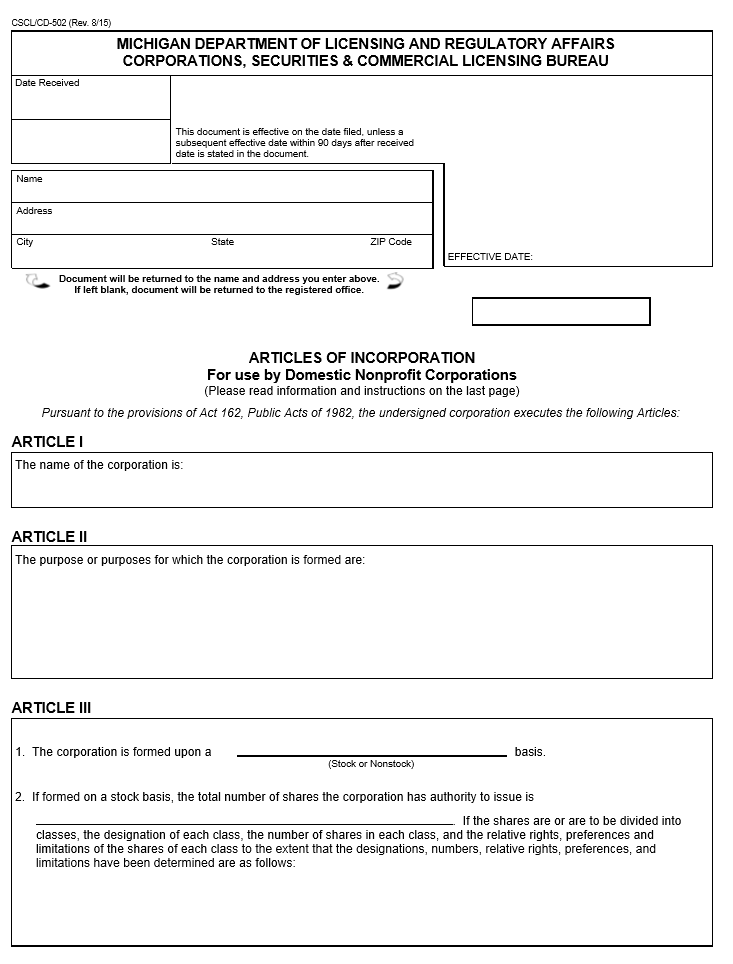

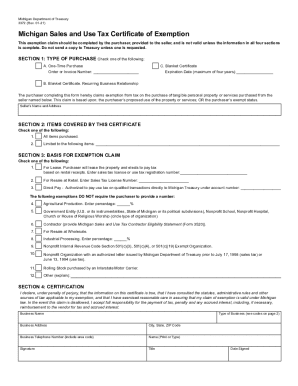

Nonprofit Internal Revenue Code Section 501c3 501c4 or 501c19 Exempt Organization. Form 3372 Michigan Sales and Use Tax Certificate of Exemption Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits Fund Raisers -.

Sales And Use Tax Exemptions For Nonprofits

A copy of the federal exemption letter or a letter previously issued by this department must accompany a completed Michigan Sales and Use Tax Certificate of Exemption form 3372.

. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable nonprofit. 05-15 Michigan Sales and Use Tax Certificate of Exemption.

Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit. How to apply for Michigan sales tax exemption. RAB 2016-18 Sales and Use Tax in the Construction Industry.

Once your organization receives your 501c determination letter from the IRS it will automatically be. Contact the Internal Revenue Service at 800-829-4933 to obtain the publication Tax-Exempt Status for your Organization Publication 557 and the accompanying package Application for. A real personal item or service is reported to be within its principal use when it is.

Form 3520 Michigan Sales and Use Tax Contractor Eligibility. Michigan Department of Treasury 3372 Rev. Apply for exemption from state taxes.

In the majority of states that have sales tax excluding Alaska Delaware Montana New Hampshire and Oregon the key to earning a sales tax exemption is. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax. 03-16 Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS.

501c3 Tax Exemption is Key. Sales Tax Exemptions in Michigan. DO NOT send to the Department of Treasury.

Certificate must be retained in the. Michigan Department of Treasury 3372 Rev. DO NOT send to the Department of Treasury.

Nonprofit Organization with an authorized letter issued by Michigan Department of. DO NOT send to the Department of Treasury. The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable nonprofit.

If a purchase is made with the principal use in mind a sales tax exemption may be requested. The following exemptions DO NOT require the purchaser to provide a number. Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax exemption on.

Michigan Nonprofits and Sales Tax Exemptions. State income tax exemption. 09-18 Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Church Government Entity Nonprofit School or. Several examples of exemptions to the.

Michigan Department of Treasury 3372 Rev. Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Amazon Certificates Required State For Exemption Tax Refund User Guide Manuals

Michigan Addresses The Inclusion Exclusion Of Gains In The Sales Factor Forvis

Contractors Working With Qualified Native American Tribes May Be Exempt From Sales Use Tax Beene Garter A Doeren Mayhew Firm

Which Organizations Are Exempt From Sales Tax Sales Tax Institute

Do Arizona Nonprofit Organizations Pay And Or Collect Sales Taxes Asu Lodestar Center For Philanthropy And Nonprofit Innovation

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

Florida Passes Marketplace Facilitator Sales Tax Law Action Required For Nonprofits And Events Charging For Spectators Runsignup Blog

Start A Nonprofit In Michigan Fast Online Filings

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

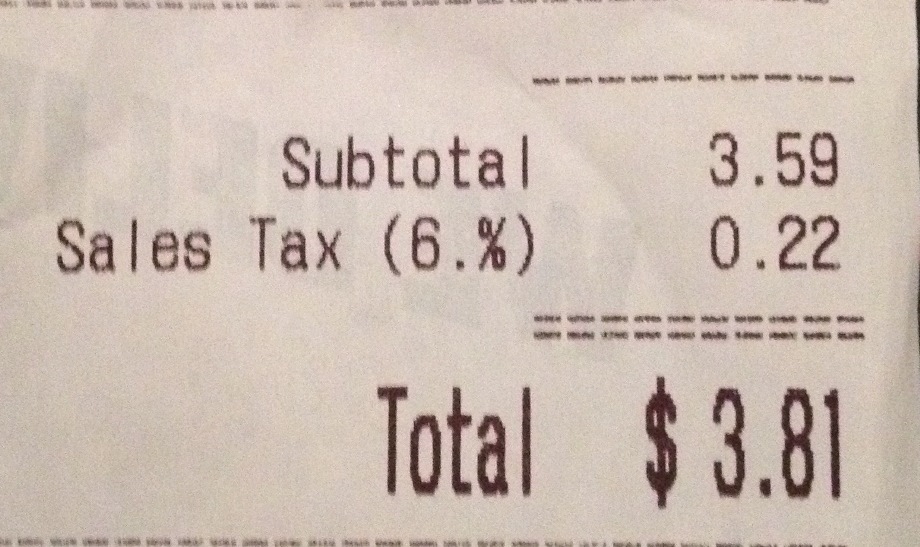

States With Minimal Or No Sales Taxes

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Free Michigan Articles Of Incorporation For Use By A Nonprofit Corporation Form Cscl Cd 502

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Form E 595e Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Nonprofit Sales Tax Exemption Semantic Scholar

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

If Sales Tax Is Passed Michigan Would Have The Second Highest In The U S Michigan Capitol Confidential

Sales Taxes In The United States Wikipedia

Sales Tax Exemption For Building Materials Used In State Construction Projects